RCS Market Size Data

According to a report by Mordor Intelligence, RCS is expected to reach a CAGR of 40.51% during the period 2019-2024. High market growth is expected to come from the APAC region.

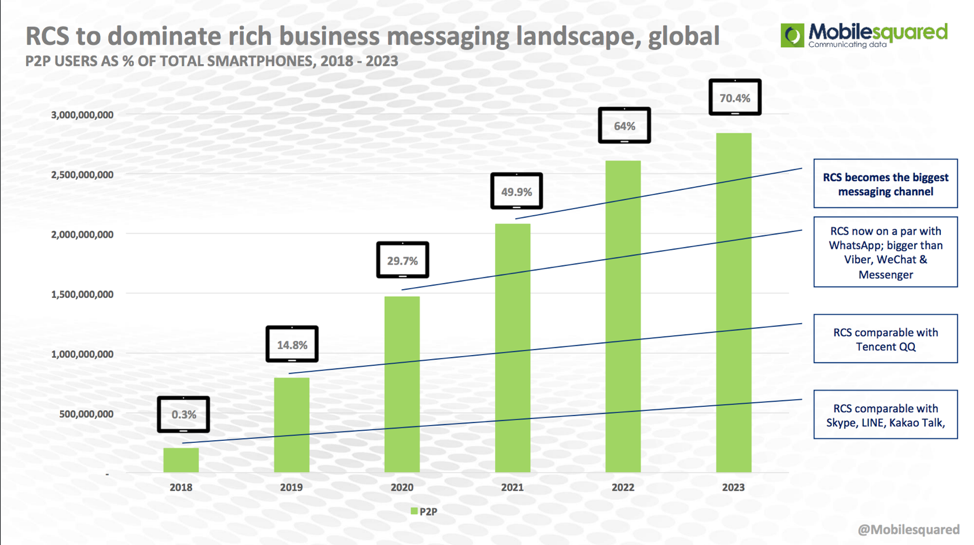

A 2019 report from Mobilesquared gives some highly positive insights into the RCS opportunity. Below are some highlights. You can download the full report from our Resources section.

- The RCS market will be worth £16.2 in 2023 (based on messaging and chat) - RCS market potentially worth £38.5billion in 2023 (based on messaging, chat, advertising and search)

- RCS is now on a par with WhatsApp if comparing P2P users a % of total smartphones

- Consumers will engage with at least two brands every day by 2023 via RCS

- There are 3.5 billion smartphones, of which 2.8 billion are Android. Based on the Android devices that are RCS compliant today, Mobilesquared believe the potential reach is just over 900 million devices worldwide – to be clear, these are not “Active Users”

- As of the end of 2018, there were 203 million Android users globally, and by the end of Mobilesquared's forecast period in 2023, there will be 2.8 billion RCS users. That is exponential growth

- By the end of 2019, there will be 790 million RCS P2P users, at which point RCS has caught up with Tencent’s QQ. By the end of 2019, 14.8% of total smartphone users will be on RCS

- In 2021, RCS will officially become the world’s biggest business messaging platform, with more than 2 billion users, accounting for 50% of total smartphone users

Global Launch Status

According to the GSMA, as of October 2019 there were 81 launched RCS networks, and 295 million global monthly active users. Another 27 operators are expected to launch RCS by Q1 2020.

Below is a list of operators that have launched RCS and the countries in which it is available:

| Country | Region | Operator |

|---|---|---|

| Albania | Europe | Telekom Albania (OTE) |

| Albania | Europe | Vodafone |

| Argentina | Latin America | Claro (America Movil) |

| Australia | Asia Pacific | Telstra |

| Brazil | Latin America | Nextel |

| Brazil | Latin America | Oi |

| Cameroon | Sub-Saharan Africa | Orange |

| Canada | North America | Bell (BCE) |

| Canada | North America | Rogers |

| Canada | North America | Telus |

| Chile | Latin America | Claro (America Movil) |

| China | Greater China | China Mobile |

| Columbia | Latin America | Claro (America Movil) |

| Congo, Democratic Republic | Sub-Saharan Africa | Orange |

| Costa Rica | Latin America | Claro (America Movil) |

| Cote d’Ivoire | Sub-Saharan Africa | Orange |

| Czech Republic | Europe | Vodafone |

| Dominican Republic | Latin America | Claro (America Movil) |

| Ecuador | Latin America | Claro (America Movil) |

| El Salvador | Latin America | Claro (America Movil) |

| France | Europe | Free Mobile(Iliad) |

| France | Europe | SFR (Altice Europe) |

| Germany | Europe | Telekom (Deutsche Telekom) |

| Germany | Europe | Vodafone |

| Greece | Europe | Cosmote (OTE) |

| Greece | Europe | Vodafone |

| Guatemala | Latin America | Claro/Movistar (America Movil) |

| Guinea | Sub-Saharan Africa | Orange (Sonatel) |

| Guinea-Bissau | Sub-Saharan Africa | Orange (Sonatel) |

| Hondruras | Latin America | Claro (America Movil) |

| Hungary | Europe | Magyar Telecom |

| Hungary | Europe | Vodafone |

| India | Asia Pacific | Reliance Jio (Reliance Industries) |

| India | Asia Pacific | Vodafone Idea |

| Ireland | Europe | Vodafone |

| Italy | Europe | Vodafone |

| Japan | Asia Pacific | KDDI |

| Japan | Asia Pacific | NTT DOCOMO |

| Japan | Asia Pacific | SoftBank |

| Jordan | Middle East and North Africa | Orange (Jordan Telecom) |

| South Korea | Asia Pacific | KT |

| South Korea | Asia Pacific | LG Uplus |

| Korea, South | Asia Pacific | SK Telecom |

| Madagascar | Sub-Saharan Africa | Orange |

| Malaysia | Asia Pacific | Celcom (Axiata) |

| Malta | Europe | Vodafone |

| Mexico | Latin America | AT&T |

| Mexico | Latin America | Movistar (Telefonica) |

| Mexico | Latin America | Telcel (América Móvil) |

| Moldova | Commonwealth of Independent States | Orange |

| Morocco | Middle East and North Africa | Orange |

| New Zealand | Asia Pacific | Vodafone |

| Nicaragua | Latin America | Claro (America Movil) |

| Niger | Sub-Saharan Africa | Orange |

| Norway | Europe | Ice |

| Norway | Europe | Telenor |

| Norway | Europe | Telia |

| Panama | Latin America | Clara (America Movil) |

| Paraguay | Latin America | Claro (America Movil) |

| Peru | Latin America | Claro (America Movil) |

| Philippines | Asia Pacific | Globe Telecom |

| Portugal | Europe | Vodafone |

| Puerto Rico | Latin America | Claro (America Movil) |

| Romania | Europe | Orange |

| Romania | Europe | Telekom Romania (OTE) |

| Romania | Europe | Vodafone |

| Russian Federation | Europe | MTS (Sistema) |

| Senegal | Sub-Saharan Africa | Orange (Sonatel) |

| Slovakia | Europe | Orange |

| Slovakia | Europe | Slovak Telekom (Deutsche Telekom) |

| South Africa | Sub-Saharan Africa | Cell C |

| South Africa | Sub-Saharan Africa | MTN |

| South Africa | Sub-Saharan Africa | Telkom |

| South Africa | Sub-Saharan Africa | Vodacom |

| Spain | Europe | Movistar (Telefonica) |

| Spain | Europe | Orange |

| Spain | Europe | Vodafone |

| Spain | Europe | Yoigo (Masmovil) |

| Sweden | Europe | Telia |

| Tunisia | Middle East and North Africa | Orange |

| Turkey | Middle East and North Africa | Vodafone |

| United Kingdom | Europe | 3 (CK Hutchison) |

| United Kingdom | Europe | EE |

| United Kingdom | Europe | 02 |

| United Kingdom | Europe | O2 (Telefonica) |

| Uraguay | Latin America | Claro (America Movil) |

| USA | North America | AT&T |

| USA | North America | Other |

| USA | North America | Sprint (SoftBank) |

| USA | North America | T-Mobile (Deutsche Telekom) |

| USA | North America | US Cellular (TDS) |

| USA | North America | Verizon Wireless |

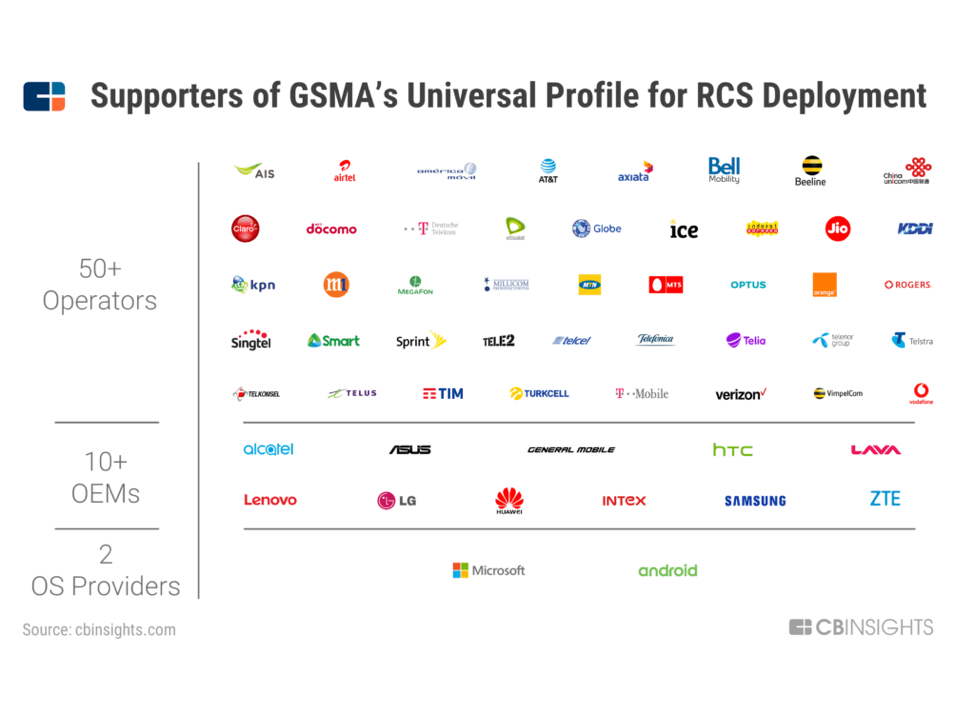

The Universal Profile (UP) has been evolving steadily since its initial introduction in late 2016. UP 2.0 in June 2017 saw the introduction of features for chatbots and RCS Business Messaging. The current version, UP 2.2, expanded on those features. The chart below from CBInsights shows the ecosystem players that support the UP.

The Role of Google

One big boost for the UP standard was Google’s decision to support it; its Android Messages app supports the standard.

Google also bought the startup Jibe Mobile in 2015, which focuses on interoperability of advanced messaging across networks. Jibe Hub, a cloud-hosted platform, connects operator networks to the RCS backbone around the world, and Jibe Cloud is Google’s hosted RCS platform. The Jibe products are just two components of Google’s efforts to create a full technology stack that is UP compliant.

While carrier adoption is one route to expanding RCS’ footprint, in June 2019 Google decided to approach deployment from a different angle, beginning the rollout of a peer-to-peer version, starting in the U.K. and France, essentially employing the network to boost the number of RCS users. Users will experience this when they see a “Chat” prompt; if they click “Yes” it gives enables them for RCS. When an RCS user connects to another RCS user, they can continue their conversation in RCS, enabling its rich features.

The Status of Apple

It should be noted that Apple has not yet released their version of RCS. Apple is in discussions with the GSMA and operators about incorporating RCS in iOS, and at this point Apple is keeping their RCS plans close to their vest. How big a liability that is for RCS is a matter of perspective. As was stated above, iOS accounts for less than a quarter of mobile operating systems globally, and in the US July 2019, OS market share for iOS is 55% with Android close behind at 44% (Statcounter GlobalStats) and growing. North America as a whole is a 50/50 tie between the two, giving RCS significant penetration even in the biggest Apple market.

Business Model and Pricing

At this point, any brands that are active in SMS should be experimenting with RCS, because testing/piloting RCS is still relatively low-cost. A number of different aggregators, including Sinch, OpenMarket, 3Cinteractive, Samsung, and Mobivity are helping marketers develop on this new platform. Initial executions do not have to be complex to be effective, both in delivering enhanced services to consumers and in terms of what learnings they can deliver to brands, particularly because, as was said earlier, RCS’ tracking and metrics far surpass those of SMS.

For now, RCS is being priced by carriers on a per message basis, similar to SMS, with the per message cost going down as the scale of an initiative expands. But the pricing model could change. It’s easy to see, for instance, how RCS could be better priced on a per session basis since it involves more back and forth between customer and business.

A February 2018 survey by Sinch gives some insight into where the business model and pricing may go. Conducted among over a hundred enterprises, operators and messaging providers in Europe, Asia and North America, it found:

- Respondents think enhanced functionality won’t mean excessively increased price,

- There is no consensus on who should pay for data consumption. While in the OTT messaging app universe the consumer pays, there are varying opinions of how this will work with RCS, from maintaining the model in which the consumer pays to having data cost be sponsored by brands or carriers.

- Most enterprises (67%) plan to offer SMS and MMS as an alternative to RCS.

Clearly, this is an evolving ecosystem with many areas yet to be decided. Becoming part of the RCS ecosystem early gives brands the advantage of having a seat at the table in this important ongoing discussion.